Why I Don’t Use StopLoss Orders (2023)

Making use of Stop Loss Orders

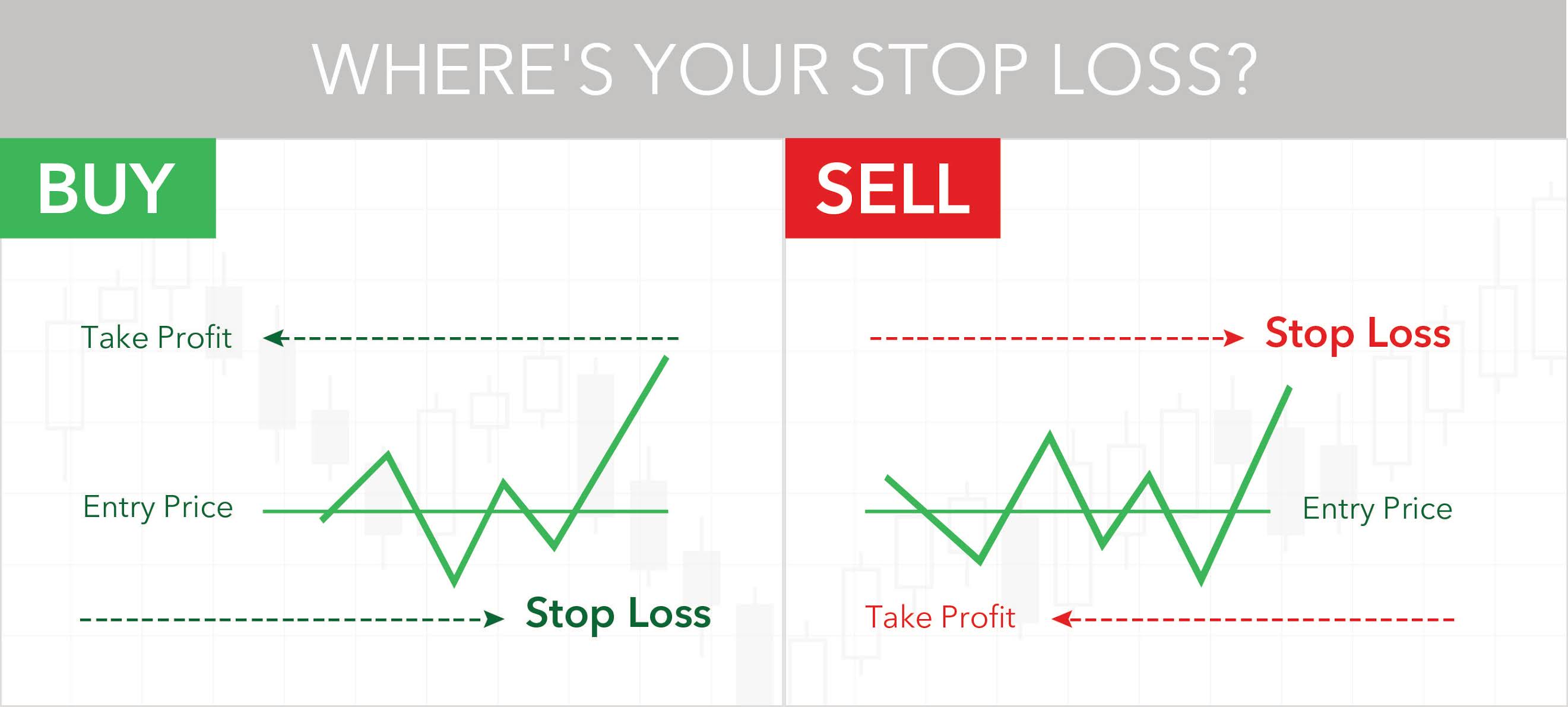

There are two main stop orders: stop-loss and stop-entry. 1. Stop-loss order. This is when you exit a trade when a price moves against you and hits a certain level of loss - limiting future losses for you. Stop-loss orders can also potentially result in profit if set above the opening level (in the case of a long position, or below it in the.

Stop Loss Order ++ Definition & Beispiele Trading.de

Buy Stop Limit Order. A buy stop loss limit order is an order to buy a specific number of shares at a limit price. The buy stop limit order is used to close short positions above your entry price. As an example, if you are short Apple at $500 and place a buy stop limit order at $525, then your position will be liquidated at the set price of $525.

The Importance of Stop Loss Orders and How to Use Them

A stop order is one of the three fundamental order types in financial markets, alongside market and limit orders. Its behavior is intrinsically tied to the direction of market prices. When the market moves in a particular direction, a stop order is poised to take action. For example, if the market is on a downward trajectory, a stop order can.

UPSTOX STOP LOSS ORDER, How to place stop loss order in upstox

If XYZ Corp. was trading at $100 a share, you could issue a stop loss to sell at $90 and feel like a winner if it fell to $80. One benefit, experts say, is the stop-loss order is put in during a.

What are stop loss orders ? Uses and Advantages

Listed below are 5 situations when your stop loss order won't work correctly: The stock price is lower than the bottom price. The market is extremely volatile. You assume you can completely predict price movements. You aren't watching your portfolio closely. The limit price is too close to the stop loss price.

What is a stoploss order and how it is placed? YouTube

Stop loss orders are trading directives given to brokers to either sell or buy a security when it reaches a specific price level. They aim to limit potential losses or secure profits for investors. These orders are beneficial as they can help investors manage their risk tolerances effectively within their investment goals.

How to place Stop loss order on Upstox Pro? YouTube

Looking back to our example, a stop-loss order made for 20 shares of TSLA at $325.50 cap any potential loss, and the investor would gain a $10.50 profit per share if the stock drops (market price of $325.50 minus $315 cost basis = $10.50. The only risk posed by a stop-loss order is that it might stop out.

Top Tips for Using StopLoss Orders StocksToTrade

A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price, designed to limit an investor's potential loss on a trading position. Sell-stop orders.

Why I Don’t Use StopLoss Orders (2023)

Stop-Loss Order: A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. Stop loss orders are designed to limit an investor's loss on a position in.

How to Use Stop Loss Orders (The RIGHT Way) YouTube

Stop-loss orders are market orders in disguise. Market orders risk horrible fills for options traders. For better execution prices, stop-limit orders are recommended. The volume, open interest, and bid-ask spread should all be taken into consideration before placing a stop-loss order on options positions. Stop-Loss Order Definition: An order.

What Is Stop Limit Order Type Best Option Strategy For Market Crash Ydeho

A stop-loss order, also referred to as a stop order, is a command to buy or sell a security once it reaches a specific price- the stop price. When the stop price is breached, the stop order becomes a market order and is fulfilled as soon as possible. Traders use stop-loss orders to limit losses or lock in profits on an existing position.

Top 5 Stop Loss Orders Strategies for Futures Trading Tips & Techniques

Example of a stop-loss order. Here's an example to illustrate the concept of the stop-loss order. Let's say you buy XYZ stock at $50 per share and want to limit your loss to 10 percent.

What is a Stop Loss Order?

Stop-loss orders: Are they effective? Learn how stop-loss orders can help you make more money and protect your investments.

Everything You Need to Know About StopLoss Orders YouTube

November 14, 2022. Help protect your position. Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. Stop orders are used most often to help protect an unrealized gain or to limit potential losses on an existing position. Here, we'll discuss how to use them in your portfolio to help protect long.

What is a StopLoss Order?

Stop-loss orders are used to set a price at which an investment will be sold. They can help investors achieve a variety of goals by setting floor and—in the case of shorting investments—ceiling prices that can limit a loss or lock in a profit. Stop-loss orders are conditional, and if the conditions aren't met, the investment won't be sold.

How to place stop loss order? What is stop loss in share market? EQSIS

If the price keeps rising, your trade never gets executed. A stop order is a conditional instruction. If the price moves past the stop price, it is triggered and converts. In the case of a stop-loss, it becomes a market order. The trade then occurs as soon as a buyer or seller is available while the market is open.