What are stop loss orders ? Uses and Advantages

How to limit losses with a stoploss order Sharesight Blog

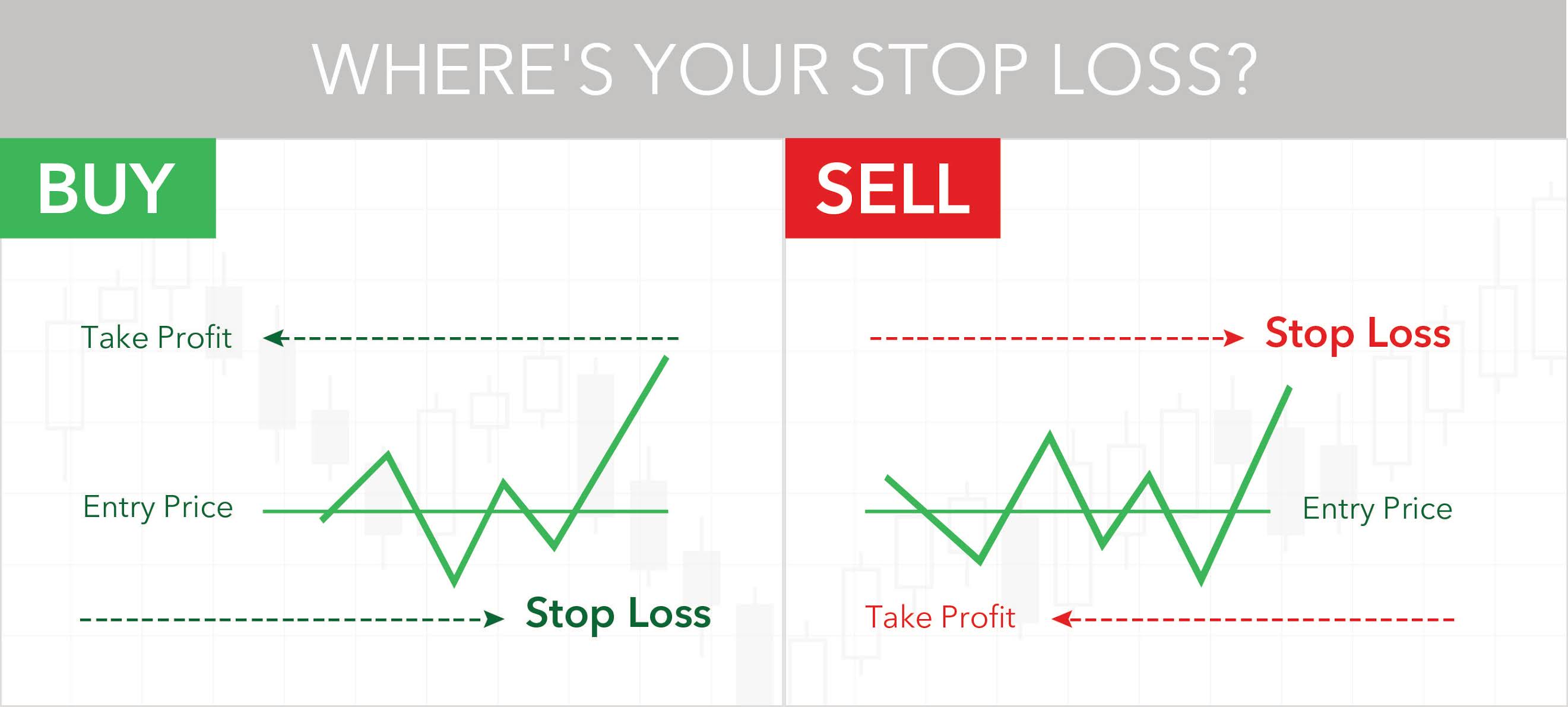

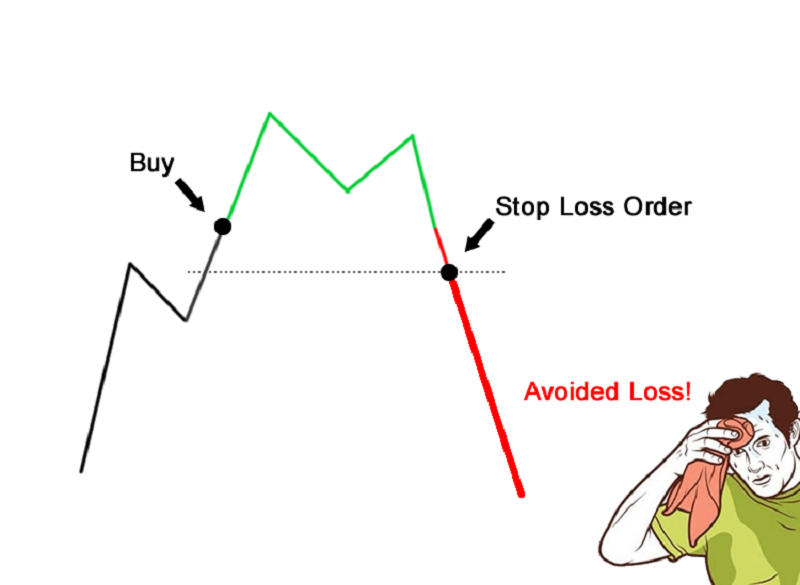

A stop-loss order, also referred to as a stop order, is a command to buy or sell a security once it reaches a specific price- the stop price. When the stop price is breached, the stop order becomes a market order and is fulfilled as soon as possible. Traders use stop-loss orders to limit losses or lock in profits on an existing position.

How to use a Stop Loss or Stop Limit Order on TD Ameritrade Thinkorswim

Yarilet Perez. Stop-loss orders are used by many stock investors as a way to limit their potential losses. But are they an equally good idea when trading exchange-traded funds (ETFs)? The answer.

What is Stop Loss Order How to Calculate a Stop Loss? BuyShares

Work is underway to begin clearing the wreckage of Baltimore's Francis Scott Key Bridge a week after a cargo ship crashed into it, sending the span crashing into the harbor and killing six.

How to Use Stop Loss Orders (The RIGHT Way) YouTube

Recently I saw a YouTube video explaining that professional traders don't use stop losses because doing so alerts market makers and algorithms to where their orders are. This is mostly nonsense especially in liquid markets with thick order books. The fact is most traders need to use stop losses to protect themselves from huge risk.

Why I Don't Use Stop Losses When Trading Vertical Credit Spreads

Stop-Loss Order: A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. Stop loss orders are designed to limit an investor's loss on a position in.

What is a StopLoss Order?

Just let me explain what a stop-loss order is, is you can set up on an existing company that you own, an existing stock shares that you own, and you can say, "Hey, if it goes below 10%, if the.

What is a Stop Loss Order? How to Use it in Trading (With Examples)

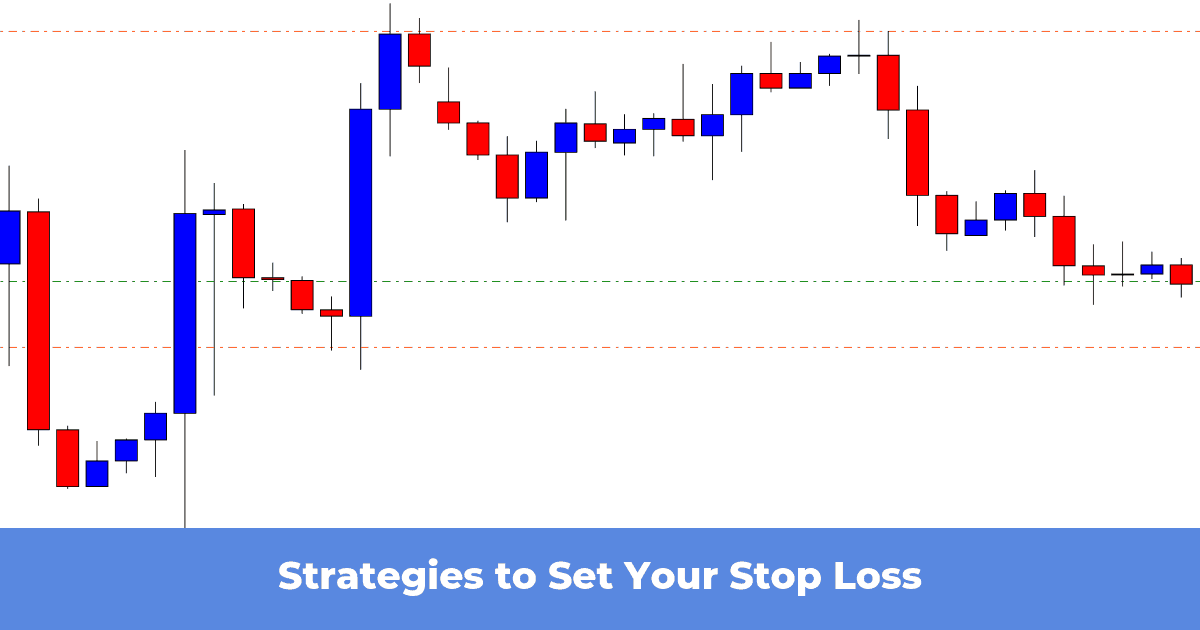

November 14, 2022. Help protect your position. Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. Stop orders are used most often to help protect an unrealized gain or to limit potential losses on an existing position. Here, we'll discuss how to use them in your portfolio to help protect long.

How To Use Stop Loss Order In Forex Trading

It is a common question, so let's dive into it here. Stop-losses, or more fully, stop-loss orders, are trading orders that are placed to execute a sale automatically if a stock falls below a specified trigger price. The idea is that these orders can prevent a small loss from becoming a large loss. It can also be used to lock in profits.

The Importance of Stop Loss Orders and How to Use Them

Hello, I would like to talk to you about stop loss orders on forex, and why I don't use it in my trading. First, not using SL does not mean not cutting losses. This means that price movements that we call Stop loss hunts, liquidity searching, squeeze - price movements that knock your stop loss and return with the price in the direction you.

What is a stop loss? A quick guide on how to use stoploss orders

In a normal market (if there is such a thing), the stop loss can work as intended. You buy a stock at $50, and enter a stop loss order to sell at $47.50, which limits your loss to 5%. In reality.

3 reasons I don't use stoploss orders for ASX shares

As you can see, LVGO fell more than 55% just a month after my original recommendation, hitting a low of $15.12 on October 2. A typical investor would have been stopped out at a loss of 20% - or.

Guide to Proper Use of Stop Losses Forex Trader Secrets

Watch level 2 for about 10 minutes and you can see it. With stop-loss orders, the stock doesn't even need to sell at your stop level. If anyone offers the stock at your stop level and it becomes the ask, it triggers your stop-loss. So if someone wants to take out stop-losses, all they need to do is paint the tape.

The Definitive Guide on How to Set a Stop Loss TradingwithRayner

A stop-loss is designed to limit an investor's loss on a security position that makes an unfavorable move. One key advantage of using a stop-loss order is you don't need to monitor your holdings.

Top 5 Stop Loss Orders Strategies for Futures Trading Tips & Techniques

In a nutshell. A stop-loss order is an investment tool that allows investors to sell a stock at a predetermined price level. Stop loss orders let investors determine how much they're prepared to lose on a security position at the time of purchase, or any time thereafter. Investors can set a floor on a stock price, at which point the sale will.

Making use of Stop Loss Orders

There's a myth about stop-loss orders that could decimate your trading account.For newbies, I've heard it called death by a thousand papercuts. Even if you study, learn my patterns, and play by the rules, this one mistake could cost you. Over time, you could churn and burn your account, never gainin.

What are stop loss orders ? Uses and Advantages

For those who do not use stop losses or other triggered actions, the noise is a non-event. The price temporarily dips and then returns to fundamental value for no impact on long term returns. With.