What Does "IRS" Stand For? YouTube

Make Your Voice Heard The IRS Taxpayer Advocate Service

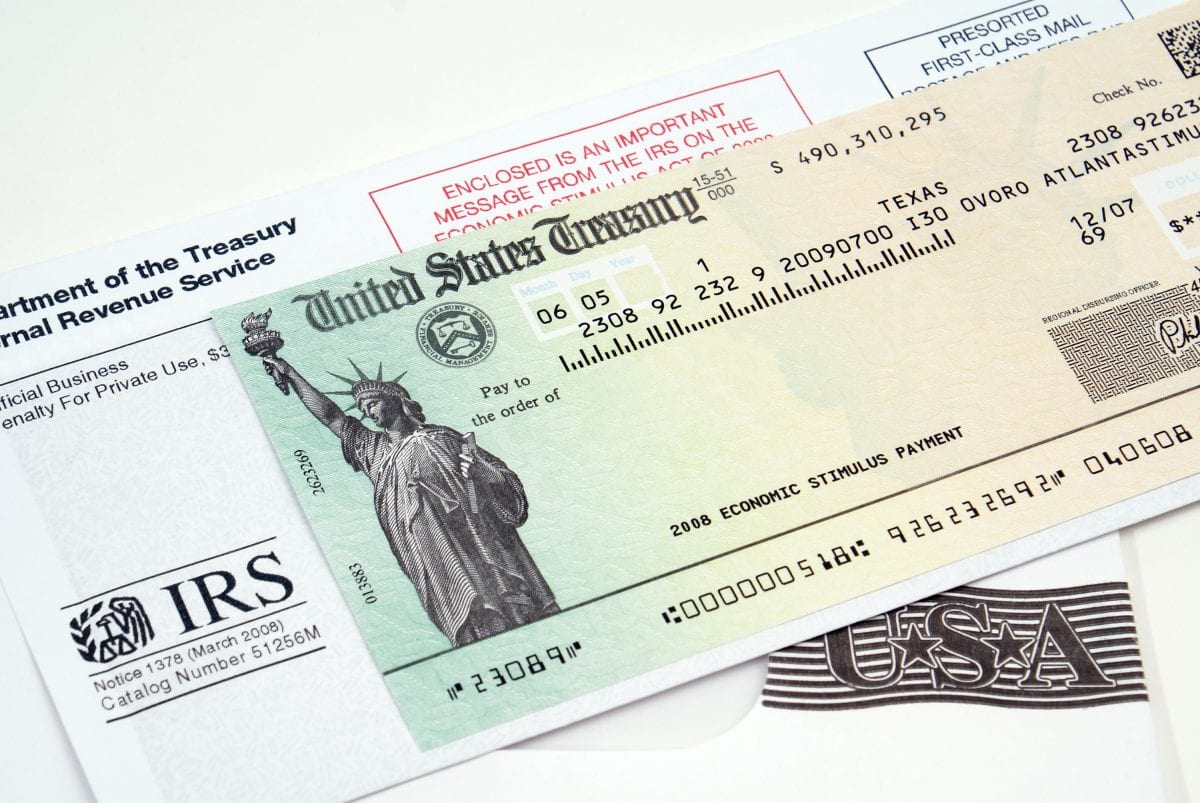

It could be: A refund from a filed tax return, including an amended tax return or an IRS tax adjustment to your tax account - this will show as being from the IRS ("IRS TREAS 310") and carry the code "TAX REF.". An Economic Impact Payment (known as EIP or stimulus payment) - this will show as "IRS TREAS 310" and have a code of.

47 Ways to Say "IRS" What do those initials really stand for? YouTube

The Internal Revenue Service (IRS) is a bureau of the U.S. Department of Treasury and is responsible for assessing and collecting tax revenue in the United States. The IRS dates back to 1862 when.

Getting an ITIN Taxpayer Advocate Service

You can call your advocate, whose number is in your local directory, in Publication 1546, Taxpayer Advocate Service -- Your Voice at the IRS PDF, and on our website at IRS.gov/advocate. You can also call us toll-free at 877-777-4778. The TAS website at TaxpayerAdvocate.irs.gov has basic tax information, details about tax credits (for.

The Taxpayer Advocate Service is your voice at the IRS. An independent

Collection Appeals Program (CAP): If you disagree with an IRS employee decision, you can appeal these collection actions under CAP: Before or after the filing of a Notice of Federal Tax Lien (NFTL). Before or after the serving of a notice of levy. Before or after the seizure of property. After the denial of a request for property to be.

TAS assistance offered at local Problem Solving Days Taxpayer

IRS. Internal Revenue Service IRSAC. Internal Revenue Service Advisory Council IRTF. Individual Return Transaction File ISRP.. TAS; Taxpayer Advocate Service TASIS; Taxpayer Advocate Service Integrated System TBOR; Taxpayer Bill of Rights ACRONYM. DEFINITION . TC. Transaction Code. TCE;

How to Understand a Letter from the IRS Philadelphia Legal Assistance

The TAS website TaxpayerAdvocate.IRS.gov can help you understand what these rights mean to you and how they apply. These are your rights. Know them. Use them. How else does the Taxpayer Advocate Service help taxpayers? TAS works to resolve large-scale problems that affect many taxpayers. If you know of one of these broad issues, please report.

NTA Blog (Part 1) Disaster Relief What the IRS giveth, the IRS taketh

The standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married couple filing jointly, up $800.

IRS What does IRS stand for?

You pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the tax rate on the next layer of income is higher.

TAS » What does TAS mean? »

The tool is designed for taxpayers who are U.S. citizens or resident aliens for the entire tax year for which they're inquiring. If married, the spouse must also have been a U.S. citizen or resident alien for the entire tax year. For information regarding nonresidents or dual-status aliens, please see International Taxpayers.

PPT TAS Angelfish Show at 2010 ACA Expo PowerPoint Presentation, free

Find common tax terms to better understand their definition and how they might apply to your tax return or account. There are few different ways to interact with the map to reveal important tax information. Enter your IRS notice number in the search field provided. Use the section-view quick links to navigate a topic area.

What does IRA stand for? What does IRA mean? M1 Finance

Form 1040-SR, U.S. Tax Return for Seniors, was introduced in 2019. You can use this form if you are age 65 or older at the end of 2023. The form generally mirrors Form 1040. However, the Form 1040-SR has larger text and some helpful tips for older taxpayers. See the Instructions for Form 1040 for more information.

TAS Tax Tip Secure Access to Your IRS Account Is Now Available Using

Find out about the Taxpayer Advocate Service, an independent organization within the IRS, that helps taxpayers solve problems with the IRS and recommends changes to prevent them..

The IRS Just Launched A Tool You Can Use To Set Up Direct Deposit For

Created in 1996, the Taxpayer Advocate Service (TAS) exists to help taxpayers who haven't resolved their disputes via normal IRS proceedings. The TAS also presents an annual report to Congress about large scale issues that taxpayers face. The most recent report presented an analysis of at least 20 of the most serious issues facing taxpayers.

What Does "IRS" Stand For? YouTube

About Us, TAS is Your Voice at the IRS. We are an independent organization within the IRS. Our job is to ensure that every taxpayer is treated fairly and knows and understands their rights. As an independent organization within the IRS, we protect taxpayers' rights under the Taxpayer Bill of Rights, help taxpayers resolve problems with the IRS, and recommend changes that will prevent the.

TAS Legacy The Infinity Reference Standard (IRS) Loudspeaker The

Follow @IRSnews on X for the latest news and announcements. Read the latest IRS tweets. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities.

How to use 2020 tax refund check from IRS to spend and save

TAS is an independent organization within the IRS. Assistance is free, but it's limited to certain circumstances, such as that your problem with the IRS is causing you financial harm. You can reach out to TAS by phone at 877-777-4778, or you can fax or mail Form 911 to request assistance.