What Is A Tax ID Number? Insurance Noon

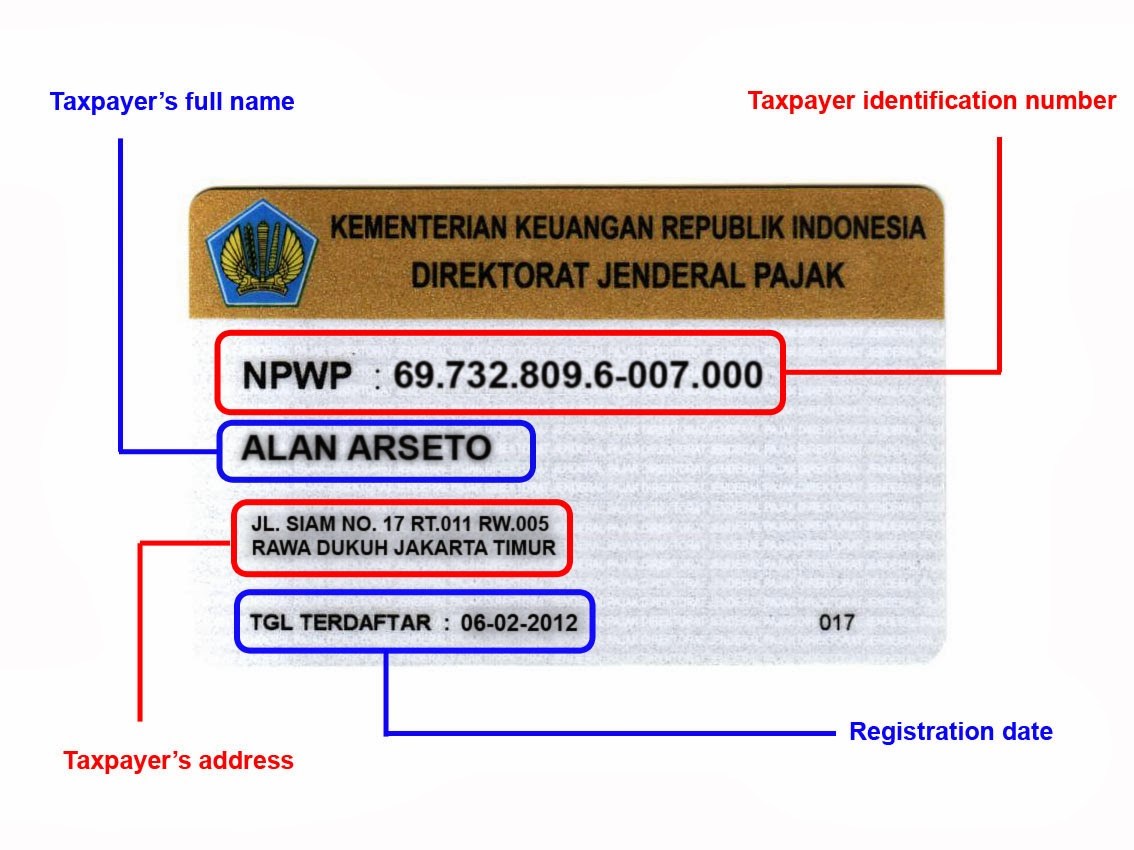

️ Langkah Demi Langkah Panduan Mendapatkan NPWP (Nomor Pokok Wajib

What is a tax ID number? 'Tax ID number'—also known as a TIN—is a term used by the IRS to signify any type of number you use to identify your business. This number can be used to file your taxes. Also, you'll need a tax ID number to open a business account or get a loan from a bank.

:max_bytes(150000):strip_icc()/tax-indentification-number-tin.asp_final-7524207031a4442187c30846d85f1ee2.png)

Tax Identification Number (TIN) Definition, Types, and How To Get One

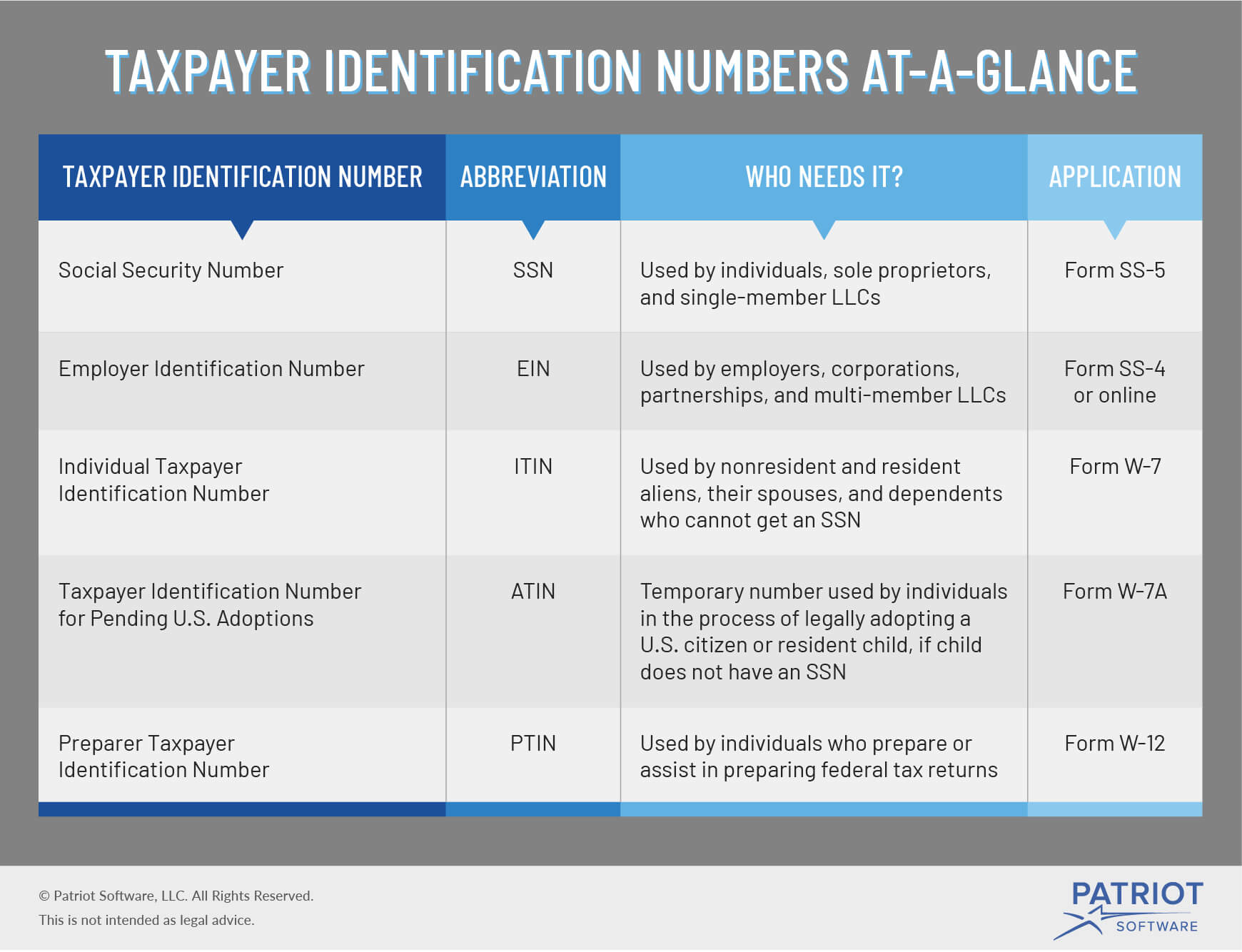

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

What Is A Tax ID Number? Insurance Noon

How To Get a Tax ID Number in 3 Steps. In order to get a business tax ID number, you'll have to fill out an online application at IRS.gov and provide the necessary information. Here are the.

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)

Differences Among a Tax ID, Employer ID, and ITIN

What is a tax ID number? A tax ID number is a unique nine-digit number issued by the Social Security Administration or the Internal Revenue Service to anyone who pays taxes. Read More: Owe Money to.

Tax ID Numbers (TIN) Types of TIN and How To Apply Shopify South Africa

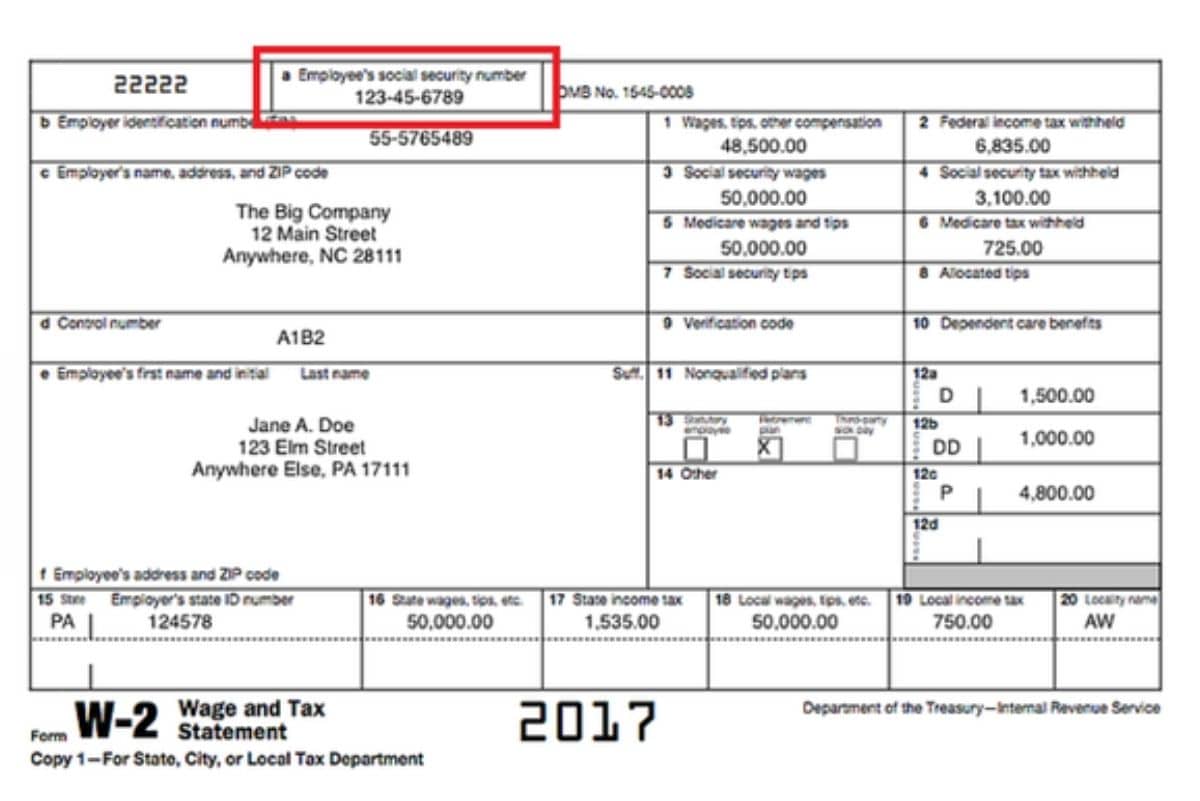

A TIN provides an identity to every U.S. taxpayer, including individuals and corporations. Individuals submit their TIN to employers to show they are eligible to work. The employer also uses the employee's TIN for tax purposes. At tax time, putting your TIN on your documents is essential to filing.

Underrated Ideas Of Info About How To Apply For Tax Identification

The IRS uses more than one type of tax identification number. The type of taxpayer ID number you need often reflects your reason for filing a tax return. Find out which numbers you may require and.

What Is A Tax ID Number? Insurance Noon

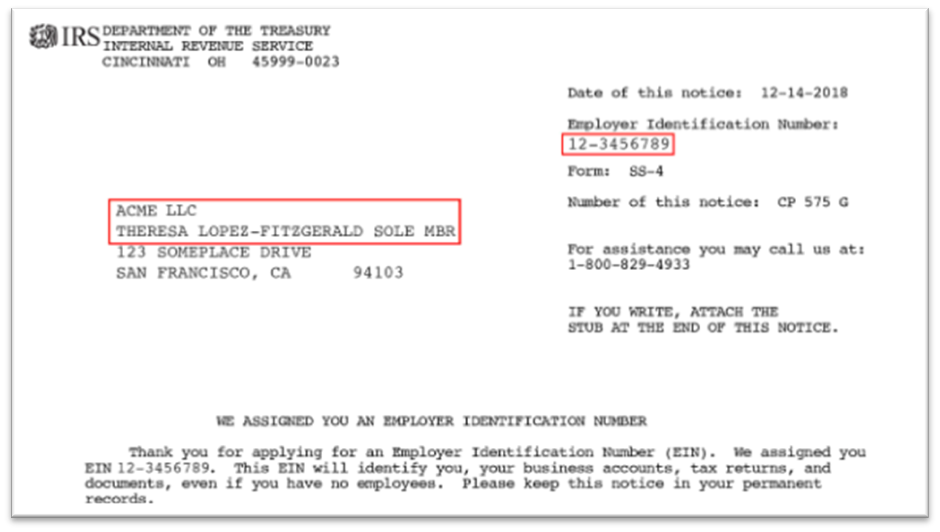

The federal tax ID number is also known as the TIN. Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity. An EIN may also be called a FEIN (Federal Employer Identification Number).

Tax Identification Number Malaysia What is a Tax Identification

Yes, you can apply for an EIN online. Just visit the IRS website and you can complete the process from your computer. Applying for a federal tax ID number is easy; all you need is a computer, a telephone or access to a post office. Learn more at HowStuffWorks.

How To Know Tax Identification Number Philippines MymagesVertical

John and Kelly's auto repair shop needs federal and state tax ID numbers to file taxes, hire employees, open a bank account, and more. The federal ID number, what's called an "Employer Identification Number" (EIN), is a unique nine-digit number issued by the I.R.S. that identifies John and Kelly's business — sort of like a Social Security number.

Taxpayer Identification Number(Tin) TIN Number

Here are the ways to apply for a FEIN and how long each one takes: Apply for an EIN online —If you fill out the EIN online application, you can get your tax ID number instantly. The IRS recommends applying for an EIN online for the fastest, easiest service. Apply for an EIN by fax —If you fax form SS-4 to the IRS, it will send an EIN to.

4 Ways to Find a Federal Tax ID Number wikiHow

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard.In the United States it is also known as a Tax Identification Number (TIN) or Federal Taxpayer Identification Number (FTIN).A TIN may be assigned by the Social Security Administration (SSA) or by the Internal Revenue Service (IRS).

Tax Identification Number India How to Apply for a TIN Online?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN).

Tax Identification Numbers (TINs) What You Need to Know

1. Look at your business's tax records. Your EIN appears on any tax return or other official correspondence between your business and the IRS or your state's taxation and revenue department. If your business is new, look for the automatic notice the IRS sent when it issued your EIN.

How to Find a Federal Tax ID Number EIN Lookup

What Exactly Is A Tax ID Number? When it comes to tax ID numbers, this actually refers to a group of identification numbers used by the IRS. From SSNs to ITINs, here's a closer look at each.

Entering Your US taxpayer Identification Number (TIN) SupplierGATEWAY

An individual taxpayer identification number, or ITIN, is a nine-digit tax ID number for nonresident and resident aliens, their spouses and their dependents who cannot get a Social Security number.

4 Ways to Find a Federal Tax ID Number wikiHow

A Tax Identification Number (TIN) is a nine-digit tracking number assigned and used to identify a taxpayer. If you receive an income, or have any reportable or otherwise taxable activity (in the.